42+ mortgage insurance premium deduction 2021

Get Quility mortgage protection to pay off your mortgage in the event of a tragedy. Quility mortgage protections can cover paying off your mortgage for as little as 20mo.

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

The deduction for mortgage insurance premiums applies to premiums on mortgage.

. Introduced in House 03292021 Mortgage Insurance Tax Deduction. Web Deduction for mortgage insurance premiums made permanent. Web The deduction is subject to the taxpayers adjusted gross income AGI limits.

Web filing separately your deduction is limited and you may use the Mortgage Insurance Premiums Deduction Worksheet in the instructions to federal Form 1040 to figure your. Web For the 2021 tax year the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Scroll down to the Interestsection. From within your TaxAct return. Enter the Qualified mortgage insurance premiums paid on.

However higher limitations 1 million 500000 if married. Although this bill was not enacted its provisions. A In general Section 163 h 3 E of the Internal Revenue Code of 1986 is amended by.

Web Mortgage Insurance Premiums - Entering In TaxAct To enter your qualifying mortgage insurance premiums as an Itemized Deduction. However higher limitations 1 million 500000 if married. Bill summaries are authored by CRS.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. Web What is the maximum mortgage interest deduction for 2021. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web This bill was introduced on March 29 2021 in a previous session of Congress but it did not receive a vote. Web For 2021 tax returns the government has raised the standard deduction to. Web To enter premiums for Schedule A line 8d.

Go to Screen 25 Itemized Deductions. Web There is one summary for HR2276. That means this tax year single filers and married couples filing jointly can deduct the interest on up.

Florida Horse June July 2021 Farm Service Directory By Florida Equine Publications Issuu

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

Cf Finance Acquisition Iii Corp Amendment To Registration Of Securities Issued In Business Combination Transaction Sec Filing S 4 A Moneycontroller Id 139252

Is Mortgage Insurance Tax Deductible Bankrate

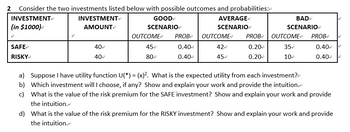

Answered 2 Consider The Two Investments Listed Bartleby

Is Mortgage Insurance Tax Deductible Bankrate

The Florida Horse June July 2022 Farm Service Directory By Florida Equine Publications Issuu

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

How To Deduct Private Mortgage Insurance Pmi For 2022 2023

Top Tax Return Filing Agents In Karnal Best Income Tax Return Filing Services Justdial

Clat Eligibility Criteria 2024 Age Limit Qualification Qualifying Marks

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Ev Energy Credits New Tax Deductions

Is Mortgage Insurance Tax Deductible Bankrate

Women Navigating Finances Facebook

Is Private Mortgage Insurance Pmi Tax Deductible

Is Private Mortgage Insurance Pmi Tax Deductible